Nothing is certain except death and taxes – Benjamin Franklin, 1789.

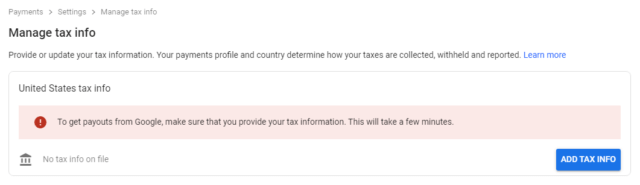

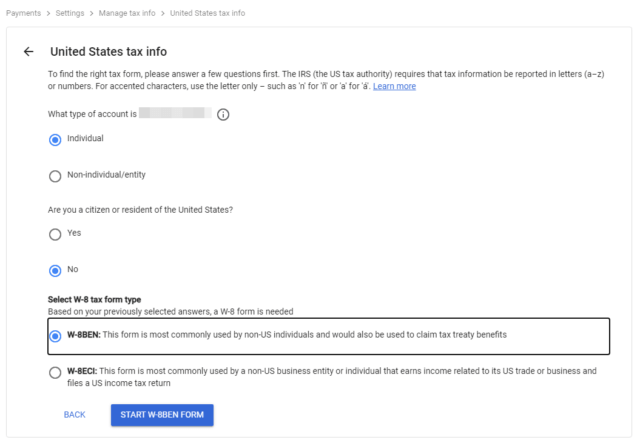

This morning I received an email from the YouTube team informing me that Google will be required to deduct US taxes from payments to creators outside the US and that I will need to supply my tax information no later than 31st May 2021. If I don’t, Google may be required to deduct the default 24% of my total earnings worldwide.

Sounds scary, doesn’t it? However, if your country already has a tax treaty with the US and the information is returned to YouTube (Google AdSense, in reality) in good time, the amount of tax depends on the treaty between the US and that country, which could be anything between 0% and 30%.

Why Is Google Doing This?

According to the email I received, the company has an obligation under Chapter 3 of the Internal Revenue Code to collect tax information for monetising creators outside the US and deduct tax in certain instances, when they earn income from viewers in the US.

For creators outside the US, we will soon be updating our Terms of Service that will mean that your earnings from YouTube will be considered royalties from a US tax perspective. This may impact the way that your earnings are taxed, and Google will deduct taxes as required by US law.

I’m actually scratching my head as to why income received from viewers in the US is considered a royalty, but mine is not to reason why, etc, etc… I will be submitting the necessary information in the next couple of days and on the face of it, the procedure doesn’t look too overwhelming. However, it does raise a number of privacy concerns because Google will need to pass a huge amount of data on citizens and organisations from all over the world to the IRS, the implications of which remain to be seen.

It’s also possible that, if you don’t supply the necessary information, you won’t even receive any payments, so it’s as well to comply, either way.

Creators in the US will not be affected by this change apparently, but it does beg the question: what if all countries took the same action and you had to pay tax in every country that your videos were viewed in? This is a serious question and we certainly don’t want to give any bright ideas like this to countries like Argentina that has one of the most swingeing tax regimes in the entire world. For instance, in Argentina, we already pay four different taxes on our monthly Netflix payment which ends up doubling the price. I wouldn’t be at all surprised if the corrupt, populist leaders of this banana republic decided to impose a tax on our videos viewed by an Argentine audience. You’ve heard the expression, “Tax ’em till the pips squeak…”, I dare say, but that’s another story for another day.

Of course, it’s entirely possible that the US government is trying to find more money to fund its war on Covid, and let’s face it, tax authorities are surgically skilled at finding novel and imaginative ways to tax citizens, so this shouldn’t come as a great surprise to anyone. The only silver lining for me at the moment is that my YouTube earnings are far from astronomical, but when one of them goes viral, just you wait, Mr. Taxman!

—

Marc,

I can’t say this is related, but the state of Maryland in the U.S. passed a law requiring tech companies to pay taxes on ad revenue generated in Maryland. I have no idea how that will work. Sounds like Google is going to pass on the costs to creators instead of Alphabet, Inc. paying up.

I’ve not heard of the IRS or Congress coming up with this yet. So far it has just been individual states.

Psst!

Don’t tell Argentina as we don’t want the thieving scoundrels getting new ideas.

By the way, I completed my tax form and since the UK has a 0% tax treaty with the US, I’m home free.

Glad to hear that as Argentina does not have a tax treaty.

For the benefit of others, I did some digging.

Go to https://irs.gov and look for Publication 515 – it explains why Google is requiring the forms. Publication 519 is the US Tax Guide for Aliens and has information on filing returns and getting refunds.

I thought filing taxes was a migraine as a US taxpayer. Little did I know!

Are you completely sure this is real and not a scam?

Sort of has the stench of being a scam.

I really don’t think it is legal to provide your tax details to a foreign gov’t without the approval of your home gov’t.

I know people work and earn income all over the world, but when you provide your tax details, you also have to notify your home tax department because it changes your status at home.

Ask your home tax department before you give those details to USA.

Marc – up here in Canada, Canadian residents are required to report income from all sources world-wide, and pay Canadian tax on same. If the resident has already paid tax to the foreign country in which said income originates, then he/she may be eligible for a foreign tax credit. Them’s the rules, and I understand it’s essentially the same in the USA. There are two big differences: 1) Canadians, except residents of Québec, file a single income tax return each year, as other provincial and territorial taxes are integrated with and included on the federal T1 and the cities/counties don’t have this particular taxing power; Americans have multi levels of income tax; and 2) Canada taxes on residency alone while the US taxes on both residency and citizenship.