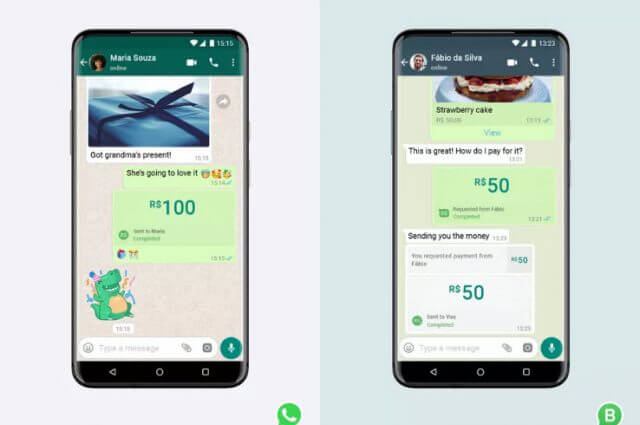

Just launched in Brazil and enabled by Facebook Pay, this new service from WhatsApp is a logical extension to the most used messaging service in the world. Facebook Pay is already available in some countries, including the USA, so with 2 billion users worldwide, WhatsApp is in an enviable position to capitalise on its market share. Clearly, local legislation is key to any digital payment service, as could be seen by WhatsApp’s attempts to launch in India during the last two years. It’s safe to assume, therefore, that India will be next to enjoy WhatsApp Pay if all goes according to plan.

Digital Payments On Your phone

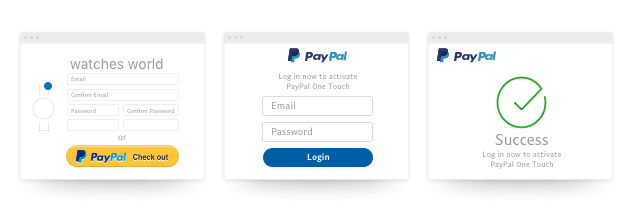

There was a time when PayPal was the only kid on the block and whilst I’ve been using it for many years, it does have its limitations, presumably due to legislation locally, so I for one am glad that more players are entering the market. Whereas PayPal doesn’t necessarily need to be in your local currency — mine is in USD — digital payments in your local currency are very convenient because you don’t need to worry about exchange rates and conversions– a big problem in Argentina, for example, which at the last count has eight different exchange rates against the US dollar. Contactless payments are seeing a huge boost due to the pandemic and, in addition to PayPal, here are a few payment providers that WhatsApp Pay will find itself up against:

- Apple Pay

- Samsung Pay

- Google Pay

- Venmo

All of these are contactless (NFC) apart from PayPal, meaning that all you have to do is place your phone near a payment terminal and voila! Some integrate with your messaging app, be it iMessage or others, so WhatsApp Pay certainly has a hill to climb for users to take up the new service. Again, one has to consider digital payment services that are truly local to a particular country, many of which can be used without a bank account or credit card.

Local Payment Providers

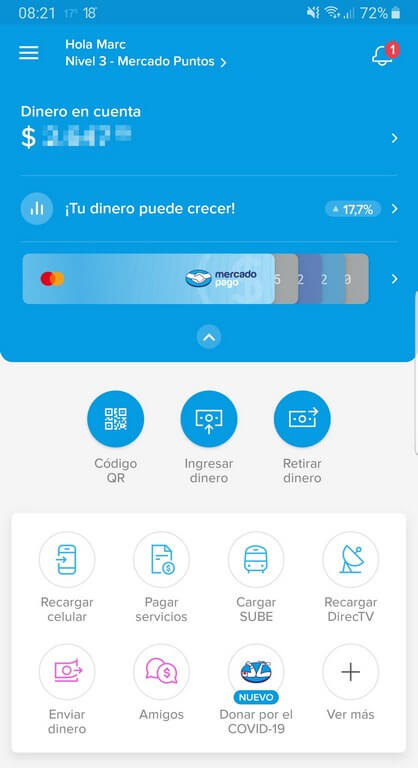

Outside South and Central America, not many people will have heard of Mercado Pago, an extension of Mercadolibre, which is a similar service to eBay or Amazon. The big difference is that users’ money from the sale of goods is held in a Mercado Pago account until it’s cleared, after which it can be used through the app, or indeed transferred to a bank account. Mercado Pago has now become fully integrated with thousands of payment services locally– phone top-ups, utility bills, etc. You can pay by QR code, send money to friends and even have a pre-paid Mastercard, so you only spend what is actually available in your account, without the need for a credit card or bank account. To break into that kind of local payment system will be a hard nut to crack for WhatsApp, but not impossible. It’s interesting that Brazil is the first country to adopt this new service, especially since Mercadolibre practically has the market sewn up in that country in a similar way to Argentina.

On the other hand, poverty rates in all South and Central American countries are very high, millions don’t even have credit, debit cards, or bank accounts and WhatsApp Pay needs to be linked to either one of those in order to work. The ability to use microtransactions is fundamental and it will be interesting to watch how WhatsApp Pay progresses in an increasingly competitive marketplace.

—