Recently, my brother asked me if he could borrow $20 for a coffee date. Yes, even the little brother can help his big brother when it is needed. The reason that I bring this situation up is that my brother introduced me to an App called Venmo. If you are reading this article, then you probably know what this App is but for the ones who don’t, here is the Wikipedia description:

Venmo – Venmo is a mobile payment service owned by PayPal. Venmo account holders can transfer funds to others via a mobile phone App; both the sender and receiver have to live in the U.S. Venmo is a type of payment rail. It handled $12 billion in transactions in the first quarter of 2018. ~ Wikipedia

I even wrote an article on Venmo back in last August. You can check that article out here– How To Update Payment Method On Venmo

Back to the point, with Venmo I sent my brother the money and then he paid me back the same way. Now the $20 is in my Venmo account. This is the first time I have been paid through this App and want to make sure the money is transferred to my checking account. How do you transfer the money using this App? That is what I will be showing you in this article. So, pull out that mobile device and get ready to move those funds to your bank (it sounds like we are doing something illegal).

How To Transfer Funds From Venmo

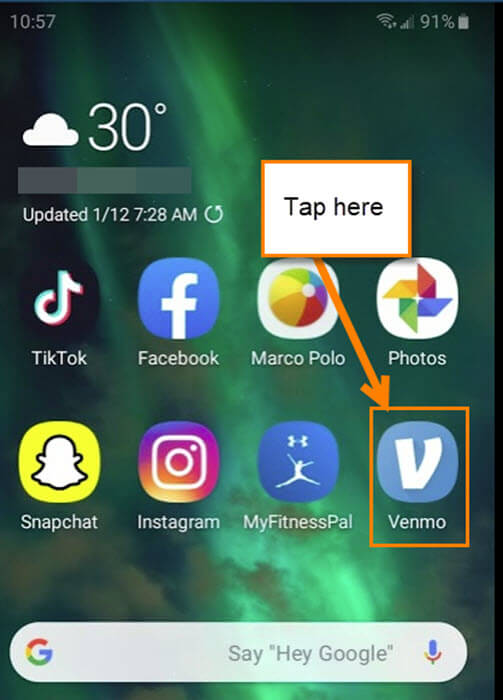

Step 1: Turn on your mobile device and find your Venmo App. Tap it.

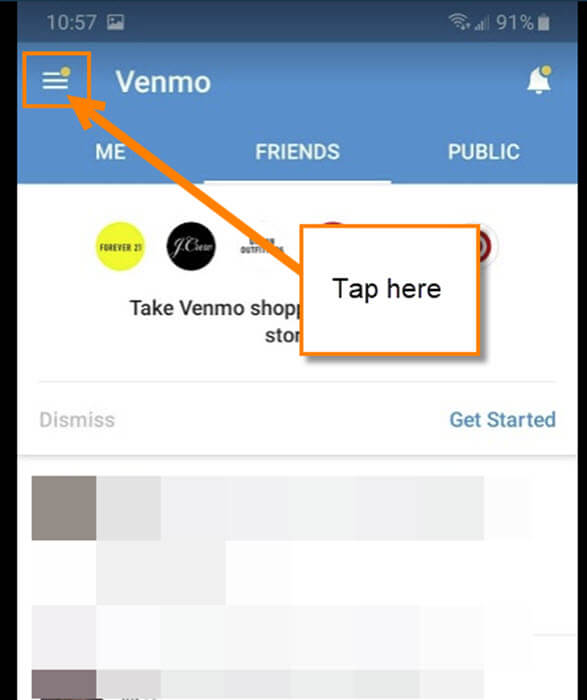

Step 2: Once in your Venmo account, look to the top left and tap the three horizontal lines.

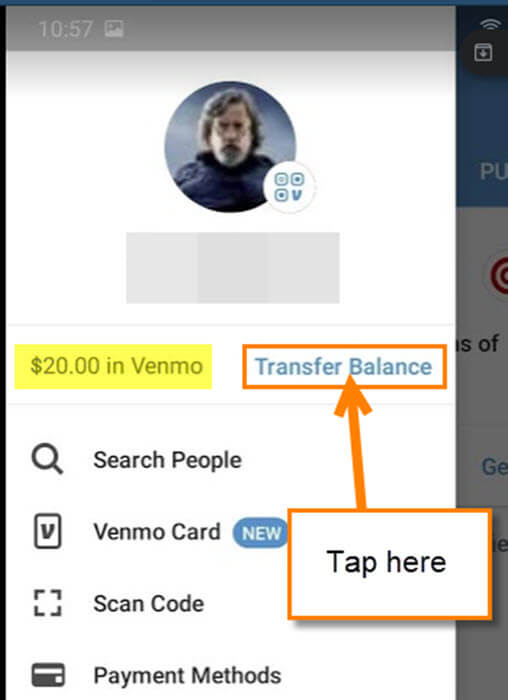

Step 3: When the menu appears, look at the top where it shows you how much you have in your account. To the right of that, you will see the link that says Transfer Balance. Tap it.

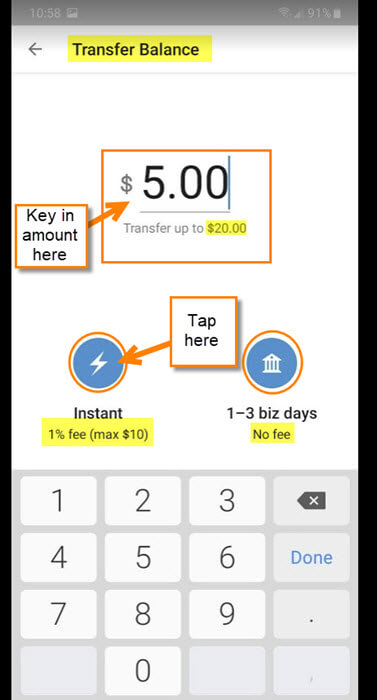

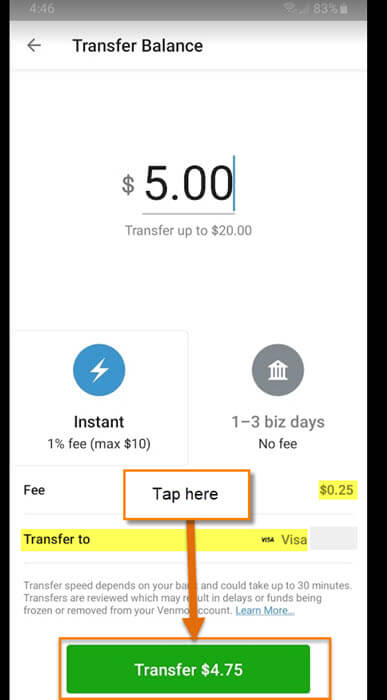

Step 4: Here you will be able to type in how much you wish to transfer out. You can do that by tapping the number that will bring up your keypad. After you have keyed in the amount, there are two options for you to decide on: You can choose instant which will cost 1% of what you transfer (up to $10), or have a 1- 3 business days (biz days) wait but has no fees. I will choose Instant since I want my money now.

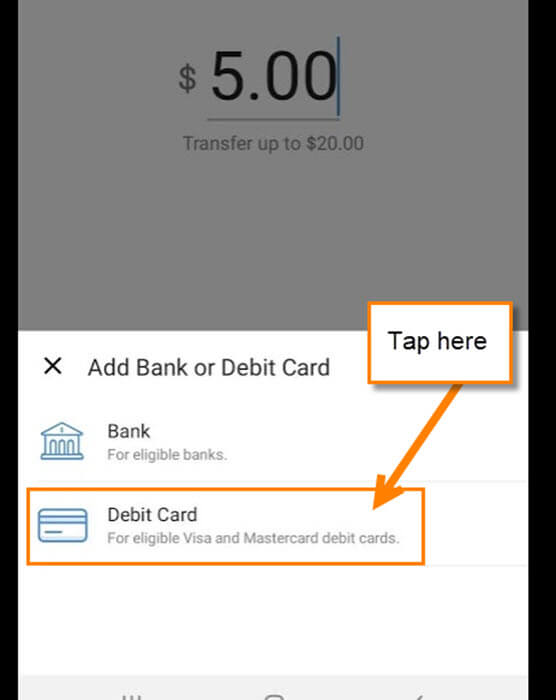

Step 5: Once you have tapped your choice, it will ask if you want to do it through a Debit card or your bank account number. In this article I will be choosing Debit. Tap it.

Side Note: If you already have your debit or bank account set up, then this option will not pop up for you.

Step 6: If you don’t have a debit card for your account, then you will need to add it on the next screen. Fill in all the information and then tap Add.

Step 7: After adding your debit card the screen that you are on will now have a green button. This screen will also show the card you are transferring to plus the fee (if it applies). If everything looks good, then it is time to tap the Green button at the bottom of the screen and complete the transfer. This is the screen you will see if you had your bank or debit card already added back at Step 5.

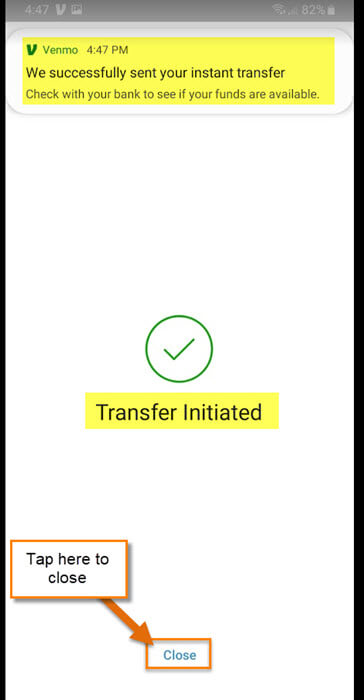

Step 8: The next screen will show that the Transfer has been initiated. It will also notify you on your phone that it was a successful transfer. Done!

We have now learned how to make a funds transfer with our Venmo account. I guess it is time to move some money around.

—

If you’re transferring $5 with a 1% fee why did they charge you 25 cents (5%) instead of 5 cents (1%)? Is there a minimum?

Hi Bruce, Thanks for pointing this out I should have covered that in this article. They have a $0.25 minimum fee for that type of transfer. Thanks.. Jason

So, for whatever reason you left the remaining $15 in your Venmo account. Most people wouldn’t do that. Why not show both examples, or better yet show the normal process with notes explaining the options? Unless, there is a reason why you need the money immediately, most people would select the 1 to 3 biz days option. Do you work for PayPal (Venmo)? Lol

By the way, we love Venmo and use it often (especially my granddaughter).

Hi Sandra, The real reason I left the other 15 in there is because I need to record a how to video on this. So I needed to leave something in there for that ;). I think I’m to impatient to wait the 3 days so I pay the fee. No I do not work for PayPal but if they want to pay me for the free advertising I give them then I’m all for that. It is a very helpful tool in this day and age. Thanks for your comment Sandra

There’s a similar service offered by most banks called Zelle which is absolutely free and can get money moved directly into your bank account instantly. I use this to pay people for services and no longer write checks. I had tenants use it to pay rent and they liked not having to mail a check. The sender only needs the recipient’s phone number or email address and the receiver can associate it through their online banking app. Because money moves bank to bank there’s no middleman, no fees and the money is available instantly.

Zelle It takes 3 days. Venmo is immediate.

Zelle is instant if both parties are already enrolled. I’ve never had any delays in sending or receiving funds. The recipients I send money to have told me they have instant access to funds received. I’ve used Zelle to receive rent payments and pay housekeepers, landscapers and others and everybody loves it particularly because it’s free and goes directly into their bank account. I’m not saying it’s better than Venmo but it’s a viable alternative that doesn’t expose banking info to a third party.

Yes, in my case, my friend had Zelle, which I asked him to send money to a friend that had only Venmo. I think that’s why there was a delay for two days.