Devaluation In All But Name

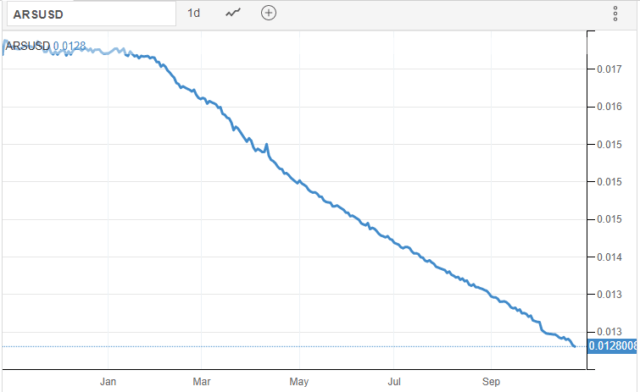

Here we go again, in what seems for many Argentines, a recurring nightmare, with the spectre of 2001 ever-present and hanging over the country like the sword of Damocles. That was the year when the country entered the record books for the world’s largest default of $93bn with many people’s life savings wiped out. Today, Argentina has an external debt of around $320bn, the central bank has run out of dollars and the Argentine peso has gone into freefall, as the above graph clearly illustrates.

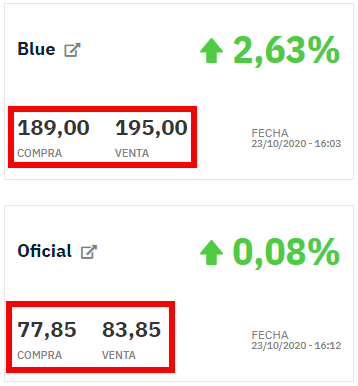

With the peso losing value several times a day — up to 17% in five days — suppliers are finding it increasingly difficult to either maintain prices or indeed to quote firm prices. In fact, any quotations I receive — which is like sucking blood from granite — are only valid for 24 hours, which I can see being cut to less than 12 hours and eventually, zero. In a recent gaming PC build, I found it impossible to extract prices from suppliers, many of whom simply ignored my calls and messages, preferring to hold onto the goods, rather than lose money. In the end, I jumped on my motorcycle, headed to the city centre, and waited in line outside a specialist computer shopping mall where I knew hardware was on sale and selling fast. Fortunately for me, the customer had paid me US dollars in advance, which I then changed (illegally) on the black market (120% difference to the official rate) and entered the store with a wad of notes the size of a large brick.

You see, with the peso practically worthless, many people are buying goods before the inevitable devaluation and this includes computer hardware, cars, and a whole range of other tangibles. Anyway, back to the store, where I was able to acquire everything I needed, handed over several wads of cash and watched patiently as the clerk popped all the notes into the cash counter — a familiar sight in most shops nowadays.

When A Country Runs Out Of Reserves

This is not going to end well.

—