Devaluation In All But Name

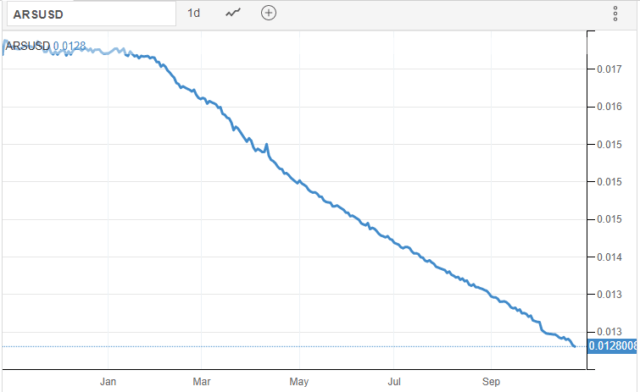

Here we go again, in what seems for many Argentines, a recurring nightmare, with the spectre of 2001 ever-present and hanging over the country like the sword of Damocles. That was the year when the country entered the record books for the world’s largest default of $93bn with many people’s life savings wiped out. Today, Argentina has an external debt of around $320bn, the central bank has run out of dollars and the Argentine peso has gone into freefall, as the above graph clearly illustrates.

With the peso losing value several times a day — up to 17% in five days — suppliers are finding it increasingly difficult to either maintain prices or indeed to quote firm prices. In fact, any quotations I receive — which is like sucking blood from granite — are only valid for 24 hours, which I can see being cut to less than 12 hours and eventually, zero. In a recent gaming PC build, I found it impossible to extract prices from suppliers, many of whom simply ignored my calls and messages, preferring to hold onto the goods, rather than lose money. In the end, I jumped on my motorcycle, headed to the city centre, and waited in line outside a specialist computer shopping mall where I knew hardware was on sale and selling fast. Fortunately for me, the customer had paid me US dollars in advance, which I then changed (illegally) on the black market (120% difference to the official rate) and entered the store with a wad of notes the size of a large brick.

You see, with the peso practically worthless, many people are buying goods before the inevitable devaluation and this includes computer hardware, cars, and a whole range of other tangibles. Anyway, back to the store, where I was able to acquire everything I needed, handed over several wads of cash and watched patiently as the clerk popped all the notes into the cash counter — a familiar sight in most shops nowadays.

Out of curiosity, I asked if I could pay by card, but was informed that a 35% surcharge would be added, so I declined. I was however encouraged to see that the shop was stacked with motherboards, memory, GPUs, and other hardware, bearing in mind that all of it is imported and left wondering how much longer they will have stock to sell.

Out of curiosity, I asked if I could pay by card, but was informed that a 35% surcharge would be added, so I declined. I was however encouraged to see that the shop was stacked with motherboards, memory, GPUs, and other hardware, bearing in mind that all of it is imported and left wondering how much longer they will have stock to sell.

When A Country Runs Out Of Reserves

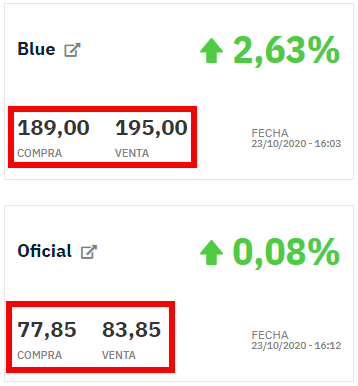

The problem is a lack of hard currency, bearing in mind that imported goods are paid for in US dollars and the Argentine government has imposed such tight restrictions and exchange controls, that access to hard currency such as dollars or euros is all but impossible, except through the black market, euphemistically referred to as the ‘blue market’. To put this in perspective, the maximum amount of US dollars anyone can officially buy at a bank at the official rate is $200, provided the moon and Saturn are in the correct phase and each customer is accompanied by their great-grandparents. Not only that, each and every online purchase with a credit card now attracts a 65% tax, plus VAT. As a result, most have withdrawn all their hard currency from the banks and what pesos they do have left over are being exchanged for dollars on the blue/black market. In the meantime, the president is encouraging people to save in pesos, is resoundingly in denial over any kind of official devaluation and so, in effect, is behaving like Nero as Rome burns.

The problem is a lack of hard currency, bearing in mind that imported goods are paid for in US dollars and the Argentine government has imposed such tight restrictions and exchange controls, that access to hard currency such as dollars or euros is all but impossible, except through the black market, euphemistically referred to as the ‘blue market’. To put this in perspective, the maximum amount of US dollars anyone can officially buy at a bank at the official rate is $200, provided the moon and Saturn are in the correct phase and each customer is accompanied by their great-grandparents. Not only that, each and every online purchase with a credit card now attracts a 65% tax, plus VAT. As a result, most have withdrawn all their hard currency from the banks and what pesos they do have left over are being exchanged for dollars on the blue/black market. In the meantime, the president is encouraging people to save in pesos, is resoundingly in denial over any kind of official devaluation and so, in effect, is behaving like Nero as Rome burns.

This is not going to end well.

—